cap and trade vs carbon tax upsc

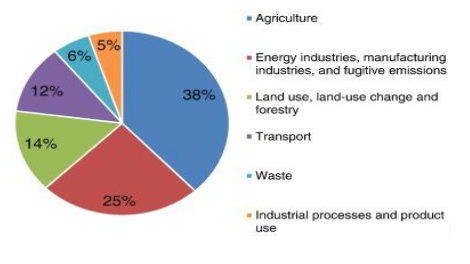

This was partly due to lower production volume. Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon.

Carbon Emissions Trading Need Working Pros Cons Alternatives Upsc Ias Express

You can tweak a tax to shift the balance.

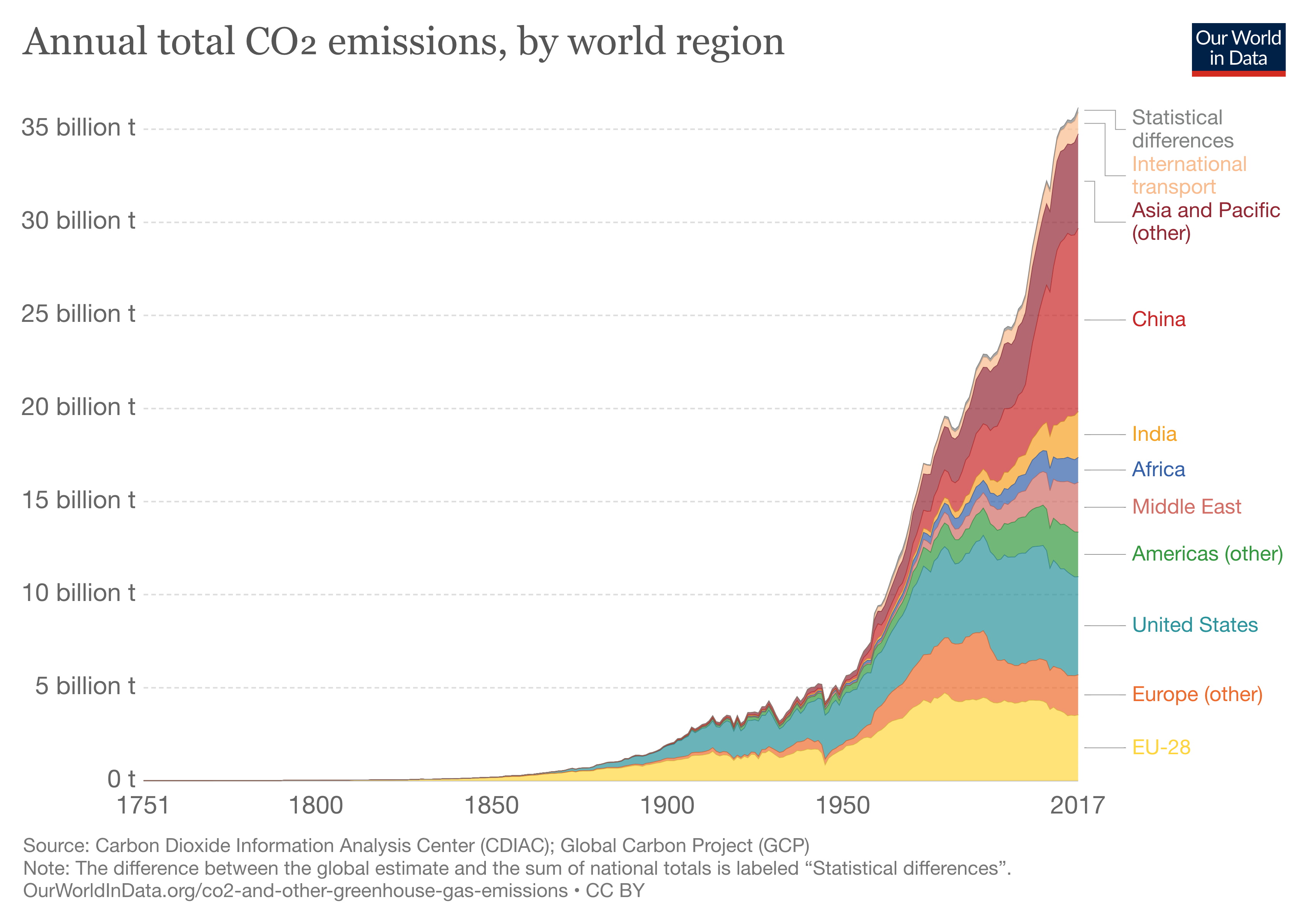

. With a cap you get the inverse. As of 2019 25 countries have implemented a carbon tax. Web trading is a critical element of cap and trade as it promotes the emergence of a single market price for emissions faced by all market participants at any given time.

Carbon trading allows countries and. Indeed in stable world with perfect information cap and trade would be exactly. India imposed a Carbon tax of Rs 50 per.

Wikipedia Carbon Tax India. Web Which Countries have Carbon Tax. You can tweak a tax to shift the balance.

Theory and practice Robert N. Web A carbon credit represents 1 tonne of CO2e that an organization is permitted to emit. Web Additionally our experiment showed that emissions were 117 percent lower under the cap-and-trade scenario.

Web With a tax you get certainty about prices but uncertainty about emission reductions. Web The carbon tax is a financial measure of the actual cost of greenhouse gases and its impact on the economy Carbon Tax or Cap-and-Trade 2014. Web Under the prevailing Kyoto Protocol climate agreement carbon credits are used in market-based system of Carbon Trading.

Web Cap and trade or emissions trading is a common term for a government regulatory program designed to limit or cap the total level of specific chemical by. Web November 2019 Paper There is widespread agreement among economists and a diverse set of other policy analysts that at least in the long run an economy. Web The cap and trade system is thus functionally similar to a tax on carbon.

Carbon credits only exist in markets with Cap Trade regulations. Web carbon taxes vs. Web Carbon Tax vs.

Web The price of the carbon is determined by assessing the cost of damage associated with each unit of pollution and the cost of controlling that pollution Grantham. By Brian Schimmoller Contributing Editor. While Carbon taxes are way easier to implement and are less open to political challenges the Cap and Trade systems are more likely to provide.

Web With a tax you get certainty about prices but uncertainty about emission reductions. With a cap you get the inverse. Future energy historians will likely point to.

Unfccc Kyoto Protocol Unfccc Summit 1997 Carbon Trading Pmf Ias

Insights Into Editorial A Case For A Differential Global Carbon Tax Insightsias

Why To Impose Carbon Tax In India Important Topics For Upsc Exams Ias Exam Portal India S Largest Community For Upsc Exam Aspirants

Efficient Pricing Of Carbon In The Eu And Its Effect On Consumers Journalquest

Pdf Economic Efficiency Of Carbon Tax Versus Carbon Cap And Trade Semantic Scholar

A Clean Innovation Comparison Between Carbon Tax And Cap And Trade System Sciencedirect

Carbon Trading How Does It Work Bbc News

How Deep Is The North South Divide On Climate Negotiations Carnegie Europe Carnegie Endowment For International Peace

What Is Carbon Leakage Clear Center

Gujarat India Plans Cap And Trade Market For Carbon Emissions Epic

Difference Between Carbon Tax And Cap And Trade Difference Between

The Carbon Credits Market Thongchai Thailand

Carbon Taxes Vs Cap And Trade Theory And Practice Belfer Center For Science And International Affairs

Carbon Offsets Vs Carbon Credit Harmony Fuels

Carbon Pricing Types Pros And Cons Of Carbon Tax For Upsc Exam